Could a salary floor lift players, MLB?

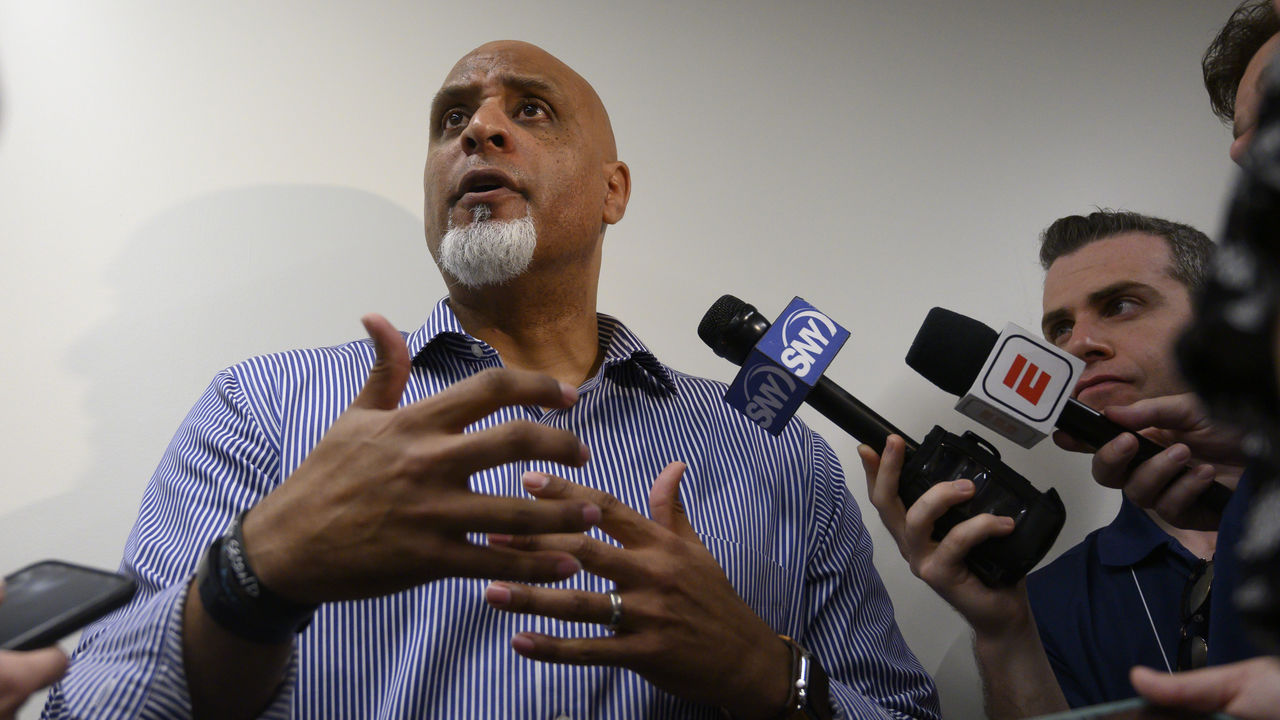

Major League Baseball floated a new idea to the MLB Players Association earlier this week: a salary floor.

A mechanism forcing teams to meet a certain payroll level exists in other major North American pro sports, but not and never in baseball. The sport's collective bargaining agreement expires at the end of the year, and one of the issues for players - and fans who don't have a seat at the bargaining table - is a lack of competitiveness and spending from some owners. Six MLB teams are set to spend less than $100 million on payroll this year, according to Spotrac's luxury payroll tracker, despite nearly every franchise (all but the Miami Marlins) valued as billion-dollar assets by Forbes, each participating in an industry worth $11 billion annually.

There's plenty of reason to be skeptical we'll see a floor in the next CBA - the union has long been against a pure cap-and-floor system. Moreover, the thresholds reportedly offered by MLB in addition to stiffer luxury-tax rates - a $100-million floor and a $180-million first-tax threshold - are too light from the players' perspective. But a soft cap already exists due to MLB's luxury tax. Only nine individual franchises have exceeded it since the current system began in 2003, and only the Los Angeles Dodgers, Boston Red Sox, and New York Yankees have paid more than $11 million in total taxes. If there's a restriction at the top end of payrolls, shouldn't there be a floor at the bottom?

While it's understandable for players to be wary of something MLB proposes, a floor could help many non-star players earn more, and perhaps make the sport more competitive. Of course, getting the players and owners to agree on anything - let alone something new - figures to be a challenge. But what might a balance point on a floor-and-tax system look like? Is there a model baseball could borrow from? Let's take a look.

There's no apples-to-apples comparison to work with here - baseball is the only Big Four sport without a true salary cap. MLB teams have extensive farm systems and rely heavily on local revenue. But like baseball, the NBA takes in a blend of national and local revenue and is more similar to MLB than the NFL in that regard. The NBA features a soft cap that is regularly exceeded. The Golden State Warriors and Brooklyn Nets each exceeded the tax threshold by $40 million last season, not too different from the Dodgers in 2021.

To arrive at its cap number, the NBA takes 44.7% of its basketball-related income (BRI) - which is less than total revenues - and divides it by 30 teams. The NBA's floor is then set at 90% of the cap level (the NHL's floor is 85% of salary midpoint).

If MLB applied the NBA's salary rules (cap and floor) to its last full, non-COVID-19 season equivalent of BRI, baseball would have had a salary floor of $122 million, according to theScore's math.

The owners would want something in return for a raised floor, though. And what they want - and what the players want to avoid - is to reduce the luxury-tax threshold.

To experiment: What happens if the proposed floor is raised by $22 million and the current tax level is lowered by $22 million, from $210 million to $188 million?

With a $122-million floor (and assuming it's a floor like the NBA's where teams with a shortfall must give the dollar difference to its existing players), there would be 13 teams under it, needing to add a combined $370 million to break even. (If a $100-million floor like MLB proposed existed this season, the six teams under as of today would be a combined $132 million below the floor.) There would be eight teams over a $188-million tax threshold by a combined $201 million this season.

Assuming those clubs treated the tax threshold like a cap with no teams exceeding it, which is unlikely, players would enjoy a net gain of about $169 million in this system ... in theory.

Now, with any rule, loopholes will be sought.

Teams would likely get creative and add players with luxury-tax numbers greater than their actual salary for that season to reduce payroll. To calculate luxury-tax numbers, players on multi-year deals have their contract's average annual value represent their tax number.

Perhaps teams under the floor would take on more bad contracts along with prospect talent from clubs looking to get under the tax threshold, which would do little to help the free-agent market. The Rangers and San Diego Padres reportedly discussed a trade like this prior to the deadline, which would have sent Eric Hosmer and his contract, along with a top prospect, to Texas for Joey Gallo and his shorter-term deal.

There could be other threshold alternatives, too.

Instead of a tax starting at $180 million like MLB proposed, there could be a restricted tier before a tax tier. This exists in the NBA: teams can exceed the cap to re-sign their own players or sign certain lower-cost free agents. A tax level could then be included in the next tier of spending. (The NBA's tax level is about $24 million more than the cap for the upcoming season.)

While it's fair for players to be skeptical of new ideas from owners, they should consider some long-term trends before an outright dismissal of the concept.

For so long, the union rejected cap proposals, and players fought to protect maximum earning potential. And it worked. Doing so allowed players to sign some of the greatest deals in professional sports, earnings that trickled down to set the market and into arbitration.

But even in their capped worlds, top NBA and NFL stars have now eclipsed the top annual average values of baseball stars. And the trickle-down approach may not continue to function as well. The problem: Fewer and fewer players are becoming free agents or even entering arbitration.

In the data era, teams understand aging curves and are less willing to spend on free agents. It also takes players more service time to become free agents in MLB than in other sports.

In a story I reported for FiveThirtyEight last summer, the MLBPA shared data that showed the average service time of players fell from 4.8 years in 2005 to 3.7 years in 2019. That's a 25% decline. While player ages have spiked up this year, the general trend is that baseball players have become younger since PED testing began. And with advances in player development at the amateur and minor-league levels, there might only be a greater supply of quality younger players on the way. Younger labor is cheaper labor.

The union wants to increase pay for younger players and will likely try to find a way to do that in their negotiations, but dramatically changing free agency or arbitration requirements figures to be a difficult task that also requires significant leverage. A floor might be an easier path.

Even if the players and owners arrived at a floor-and-tax system that kept the revenue split around the status quo, it could have considerable benefits for a number of parties.

While some star players might receive lesser contracts, scores of other players - younger and mid-tier players - might earn more. Teams may also sign more mid-tier free agents, a cohort that's seen its market dry up in recent years.

A floor would certainly benefit small- and mid-market fanbases. Imagine seeing Pittsburgh, Cleveland, and Tampa Bay regularly bidding on free agents.

Having more teams participate in the offseason could make the game more interesting to MLB fans as a whole. Having more competitive teams would certainly be of interest in the regular season.

As of Aug. 19, FanGraphs's playoff odds had 18 teams with a 2.3% or less chance of winning their division and 17 clubs with 20% or worse chances of reaching the postseason. Most of the playoff field is essentially already set.

Fans in many MLB markets have already turned their attention to NFL training camps and the NBA's summer league. The NBA has surpassed MLB's national TV deals, another indicator of waning enthusiasm. The NFL's national TV audiences passed MLB a long time ago.

Careers are getting shorter in baseball. Too many teams aren't competitive late in the summer. Not enough small-market owners seem interested in competing despite taking in revenue sharing. It's fair for players to question MLB's reasoning in proposing a salary floor, and the initial proposal is too light, but the right kind of floor and system could be a tide that lifts the sport.

Travis Sawchik is theScore's senior baseball writer.

HEADLINES

- Jazz wants $35M AAV over 8-10 years as FA, no discount for Yanks

- Judge after 2-HR spring debut: Yankees have 'unfinished business'

- Bill Mazeroski, known for walk-off HR in World Series, dies at 89

- Ohtani to play a few Cactus League games before joining Japan for WBC

- Cardinals sign Ramón Urías to 1-year deal with 2027 mutual option